Net Asset Value

Our approach

Environmental, Social and Governance

Our approach

HGEN is an SFDR Article 9 impact fund with a sustainable investment objective aligned with the climate change mitigation goal of the EU Taxonomy. During FY2023, the Company:

- Reported to the Principles of Responsible Investment for the first time and scored above median average for the peer group in each of the three reported modules, including Policy, Governance and Strategy; Confidence Building Measures; and Direct Private Equity

- Produced the Company’s first standalone sustainability report for FY 23 aligned with the IFRS International Sustainability Standards Board

- Undertook a physical climate risk assessment during the year incorporating scenario analysis from the International Panel on Climate Change’s Shared Socioeconomic pathways

- The Company’s Board gender diversity remained 50%

£132.7m

SFDR Article 9

Climate impact fund

>91,000 tonnes

CO2e emissions avoided in FY2023

Investing in clean hydrogen for a climate-positive impact

Navigating ESG

Our Impact

| 2023 | |

|---|---|

| EU Taxonomy Aligned Portfolio | 92% |

| Deployed in low-carbon growth | £113.7 million |

| Avoided GHG emissions | 91,116 tCO2e |

| Total GHG emissions | 279 tCO2e |

| Scope 1 | 18 tCO2e |

| Scope 2 | 81 tCO2e |

| Scope 3 | 180 tCO2e |

| Carbon Footprint | 2.2 tCO2e/£m |

| GHG intensity | 55.3 tCO2e/£m |

| Avoided cumulative since IPO | 141,695 tCO2e |

| Energy use – UK | 268,669 kWh |

| Energy use – Global | 2,157,604 kWh |

The Company’s scope 3 emissions consist of the scope 1-3 emissions from Private Hydrogen Assets, which are shown above.

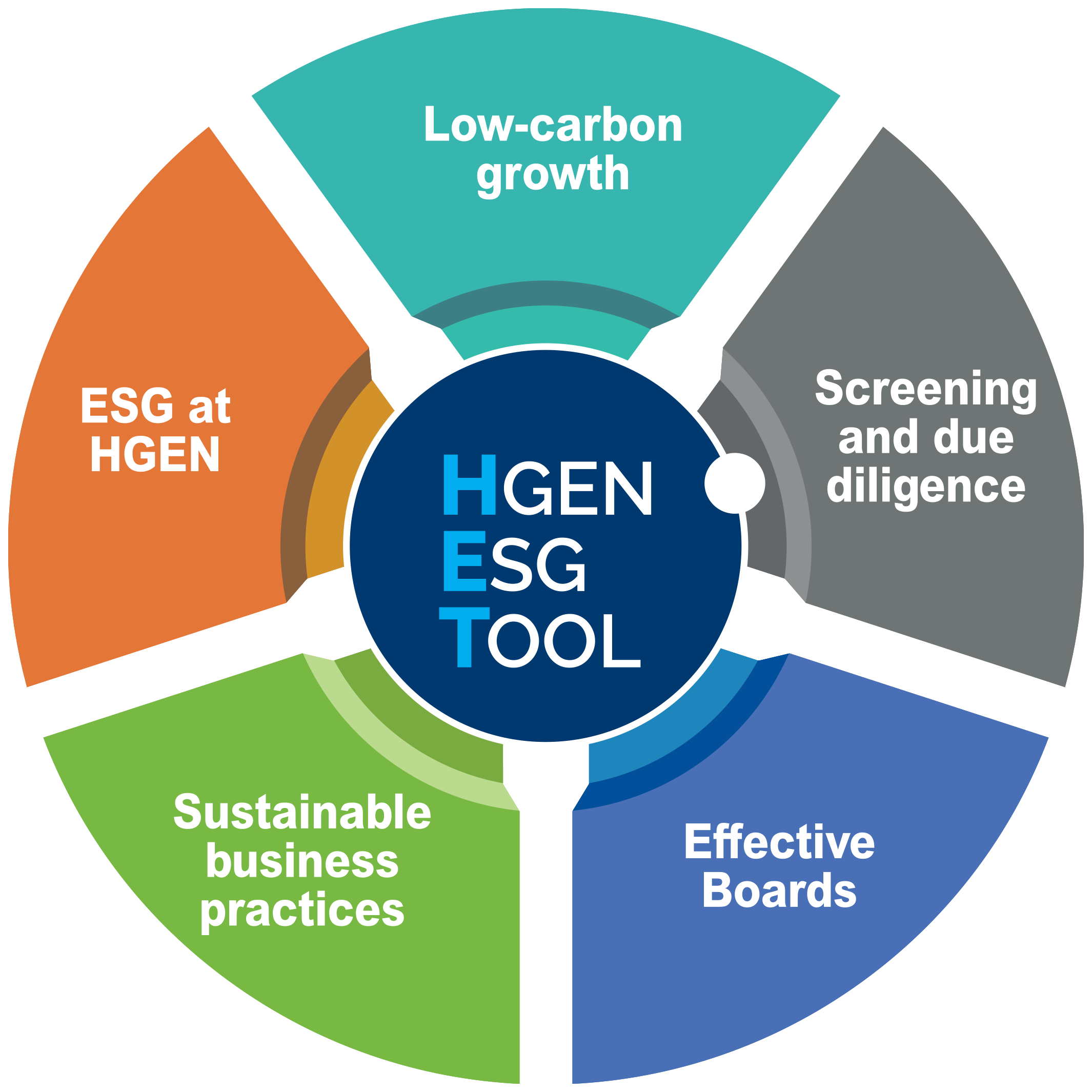

Sustainability policy – HydrogenOne ESG Tool (“HET”)

The Company has set out that when it invests, ESG criteria will be fully considered in its investment and divestment decisions and in its asset monitoring. The Board has oversight of and monitors the compliance of the AIFM and the Investment Adviser with the Company’s ESG policy, and ensures that the ESG policy is kept up to date with developments in industry and society.

Our ESG Principles

The Company has embedded the following ESG principles into its policy:

Allocating capital to low-carbon growth

The Company is focused on investing in a climate-positive environmental impact, accelerating the energy transition and the drive for cleaner air. The Directors will prioritise this long-term goal over short-term maximisation of shareholder returns or corporate profits. The Company will enable investors to back innovators in low-carbon industries by supporting the access of such companies to the capital markets.

Screening and due diligence

Prior to investment, the Company will undertake an initial screen of the prospective investment’s economic activity. This will focus on core services or products to establish provisional alignment with the EU Taxonomy. During the detailed sustainability due diligence stage, turnover, operating expenses, and capital expenditure will be assessed to ensure alignment with the EU taxonomy’s environmental objectives. The relevant do no significant harm and minimum safeguard requirements will also be assessed.

Once EU Taxonomy compliance is established, the principle adverse indicators (as defined in the Regulatory Technical Standards to the EU Sustainable Finance Disclosure Regulation) will be considered, to the extent possible, for their potential impact. The performance of the prospective investment against these criteria will be considered by the investment committee.

Engagement to deliver effective boards

The Company prioritises positive and proactive engagement with the boards of its Private Hydrogen Assets. The Directors recognise that structure and composition cannot be uniform but must be aligned with long-term investors while supporting management to innovate and grow. The presence of effective and diverse independent directors is important to the Company, as are simple and transparent pay structures that reward superior outcomes.

Encourage sustainable business practices

The Company expects its Hydrogen Assets to be transparent and accountable and to uphold strong ethical standards. This includes a demonstrated awareness of the interests of material stakeholders and engagement to deliver positive impacts on the environment and society. Hydrogen Assets should support the letter and spirit of regional laws and regulations. The Company and the Investment Adviser will encourage the adoption of initiatives including but not limited to the Task Force on Climate-related Financial Disclosures and EU Sustainable Finance Taxonomy and will encourage transparency and alignment of lobbying activities.

During 2023, the Private Hydrogen Assets were engaged to report against principal adverse indicators.

ESG in the Company

Given the nature of its investments, the Company has committed to disclosing key performance metrics (“KPIs”) that describe the environmental impact of its portfolio. The Company is particularly focused on the greenhouse gas emissions from investments and the emissions that have been avoided (“avoided emissions”) because of the investments and has actively engaged with Private Hydrogen Assets to adopt an appropriate reporting framework.

The Company frames its investments around positive contributions to UN Sustainable Development Goals (“UN SDGs”) and works within responsible frameworks such as those promoted by the UN Global Compact (“UN GC”), the London Stock Exchange’s Green Economy Mark, and the UN Principles for Responsible Investment (“UN PRI”).

The Company has no direct employees, operations, or permanent office space. As a result, there are no scope 1 or 2 emissions. Material scope 3 emissions are that of the investment portfolio of the Private Hydrogen Assets, which are the focus of this report. EU SFDR requires the presentation of GHG emissions on a look-through basis, so the portfolio’s emissions are aggregated by scope and presented as scope 1, 2 or 3 (as opposed to portfolio emissions being aggregated in scope 3 category 15).

United Nations Sustainable Development Goals

The Company’s investment objective and investment policy are closely aligned with seven UN SDGs goals:

| Goal | UN SDG target | The Company’s focus |

|---|---|---|

UN SDG 3 | Reduce deaths from pollution (3.9) | Fuel cell vehicles to displace diesel and fuel oil. Direct use in industrial activities to displace fuel oil and coal. Demonstrated through avoided emissions. |

UN SDG 7 | Increase access to electricity (7.1) Increase renewable energy in the global energy mix (7.2) Increase energy efficiency (7.3) | Enable the expansion of renewable energy through direct use of clean hydrogen and as a form of energy storage. Exclude those involved in the production of fossil fuels. |

UN SDG 9 | Upgrade industries for sustainability (9.4) Increase R&D in industrial technologies (9.5) | Enabling the decarbonisation of processes in heavy industry and enhancing innovation in transport and for a more circular economy. |

UN SDG 11 | Reduce the environmental impacts of cities (11.6) | Enabling the adoption of cleaner fuels for transportation and in heavy industry to reduce pollution and advance a more sustainable economy. |

UN SDG 12 | Adopt sustainable practices and reporting (12.6) | Engagement for good governance and transparency across the portfolio. |

UN SDG 14 | Reduce acidification (14.3) | Enabling the replacement of fossil fuels, to reduce CO2 emissions and the corresponding negative impacts on ocean chemistry. |

UN SDG 15 | Combatting desertification and land degradation (15.3) | Enabling the replacement of fossil fuels to reduce GHG emissions and the associated acceleration of global warming. |

ESG standards

Principles for Responsible Investment

As part of its commitment to sustainable investing, the Company has signed the United Nations-supported Principles for Responsible Investment (“PRI”). PRI is recognized as the leading global network for investors who are committed to integrating ESG considerations into their investment practices and ownership policies. During 2023, the Company reported to the PRI and received positive results, scoring above the median for its peer group in all categories.

LSE Green Economy Mark

The Company has been awarded the London Stock Exchange’s Green Economy Mark, which recognises companies that derive 50% or more of their total annual revenues from products and services that contribute to the global green economy. The underlying methodology incorporates the Green Revenues data model developed by FTSE Russell, which helps investors understand the global industrial transition to a green and low carbon economy with consistent, transparent data and indexes.

SDR

In late 2023 the Financial Conduct Authority issued their final rules on Sustainability Disclosure Requirements (SDR) and investment labels. This regulation introduces general anti-greenwashing rules and creates four labels for different types of sustainability funds. The Company supports measures to reduce greenwashing and clarify sustainability for investors. The scope of rules related to labels is currently limited to UK Alternative Investment Fund Managers, as such the Company cannot currently apply for a label.

CDP

The Company recognises the importance of transparency and disclosure in managing its environmental impact. In 2023, the Company submitted its first report to the Carbon Disclosure Project (CDP), a global non-profit organisation that runs the world’s leading environmental disclosure platform. The CDP report provides detailed information on the Company’s carbon emissions, climate-related risks and opportunities, and strategies for managing its environmental footprint. By participating in the CDP, the Company demonstrates its commitment to sustainability and aligns itself with global best practices in environmental reporting. The Company will continue to engage with the CDP and other relevant initiatives to enhance its environmental performance and transparency.

Carbon Neutral

The Company achieved a carbon neutral status for the year to 31 December 2023 through the offsetting (at portfolio and Company level) of scope 1 and 2 CO2e emissions. The Company considers the term carbon neutral in line with the UN Climate Change secretariat guidance, being the offsetting of emissions for the period. Whilst the Company is actively working on setting a net zero target through carbon reduction, it is important to recognise the emissions that have already occurred and take action to address these. The Company does not believe offsetting is the long-term solution to climate change. However, it is part of the action that can be taken in the short to medium term as reduction actions are implemented. To achieve the offset, the Company purchased credits from certified carbon removal projects where there is transparency over the measurement and allocation of sequestration. The credits are from a portfolio of several carbon sequestration projects verified by either Gold Standard or the Verified Carbon Standard.

- Total scope 1 and 2: 99 tCO2e

- Offset by Private Hydrogen Assets: 6 tCO2e

- Offset by the Company: 93 tCO2e

EU Sustainable Finance Disclosure Regulation (“SFDR”) and EU Taxonomy Regulation (“EU Taxonomy”)

As part of the requirements, the Company has published the following disclosures which outline how the Company aligns with the regulation and Article 9 classification: